Dr. Adrian Byrne, a Marie Skłodowska-Curie Career-FIT PLUS Fellow at CeADAR, Ireland’s Centre for AI, and also Lead Researcher of the AI Ethics Centre at Idiro Analytics

At CeADAR, we are dedicated to unlocking the potential of data analytics to provide actionable insights. A recent study led by Dr. Adrian Byrne has uncovered key factors influencing car insurance premiums in Ireland.

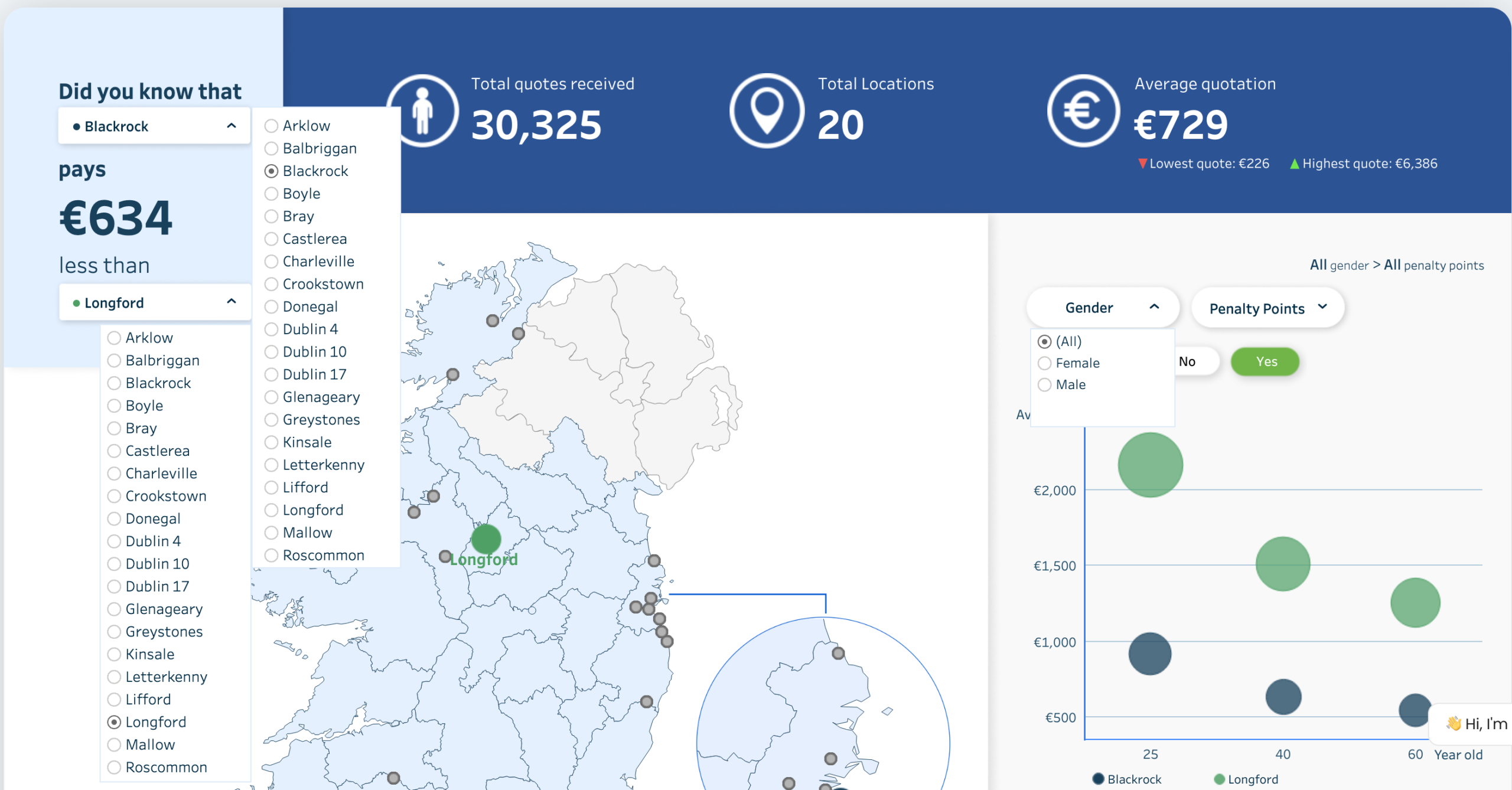

Using automated data collection, the research analysed variables such as gender, age (as a proxy for driving experience), location, occupation, and driving history. These insights, visualised in an interactive dashboard, reveal the complex algorithms insurers use to assess risk and determine premiums. Dr. Byrne highlights the study’s role in enhancing transparency and understanding among consumers and policymakers alike.

Key Findings

1. Geographic Influence

One of the standout findings is the impact of geographical location on car insurance premiums. Residents in Longford face the highest average quotes, with premiums averaging €738. This is primarily attributed to higher crime rates and road accident frequencies in the area. Conversely, locations like Crookstown enjoy significantly lower premiums, highlighting the stark contrast in insurance costs across different regions.

2. Gender & Ethnicity

The study also debunked common misconceptions about gender and ethnic biases in car insurance quotes. Our analysis found no evidence to suggest that insurance companies discriminate based on gender or ethnicity. Both male and female drivers, regardless of their ethnic backgrounds, receive similar quotes when all other factors are equal.

3. Driver’s Profession

The profession of the driver significantly influences insurance costs. Retail workers, in particular, face higher premiums compared to other occupations such as farmers, nurses, or teachers. This impact varies across locations, with retail workers in areas like Balbriggan experiencing notably higher insurance quotes. This finding underscores the need for further examination of how occupational risks are assessed by insurers.

4. No Claims Bonus (NCB) and Penalty Points

The No Claims Bonus remains a crucial factor in determining insurance premiums. Drivers who maintain a three-year NCB benefit from lower premiums, reflecting their lower risk profile. Similarly, penalty points significantly affect insurance quotes, although their impact is more pronounced in higher-premium locations. Drivers in areas with higher average premiums face stiffer penalties for accruing penalty points.

Implications for the Future

This research highlights the need for increased transparency in the insurance industry. As technologies like AI continue to advance, understanding the dynamics of insurance pricing becomes increasingly important. The findings from this study aim to foster greater transparency and fairness in the industry, ensuring that all drivers are treated equitably.

Furthermore, the study’s insights extend beyond immediate premium considerations. They provide a foundation for future research and policy considerations aimed at creating more informed and equitable practices within the insurance sector. Policymakers and stakeholders can leverage these findings to advocate for more transparent and fair insurance pricing models.

Moving Forward with CeADAR

At CeADAR, we are committed to pushing the boundaries of applied AI and data analytics. Adrian’s research is a testament to our dedication to providing valuable insights that can drive positive change in various industries, including insurance.

Stay tuned for more updates from CeADAR as we continue to explore the frontiers of data analytics. Visit here to explore the outcomes from this research further using the handy interactive table, or to download the full report or dataset.

Feel free to contact us at CeADAR@UCD.ie for any queries or further information.

- For more details, check out these articles and interviews: